Premium Invoice Delivery capabilities within your Premium Paymode membership will help you securely manage the delivery, storage and presentation of your invoices. Intelligent analytics give visibility into undelivered and un-actioned invoices that can negatively affect cash flow to help drive real-time decision making and follow-up.

A better, more secure collections strategy

A typical collections strategy revolves around a daily “aged debtor” report which highlights customer invoices that are outside of agreed payment terms. While useful, this approach allows invoices that should have been paid to age unnecessarily thus reducing the likelihood of being paid on time. With Premium Invoice Delivery, your receivables department can drastically improve your collections strategy by ensuring you:

- Check that every invoice has been successfully delivered within a secure portal.

- Identify incorrect email addresses to improve data quality and document delivery

- Quickly and effectively resolve document delivery issues without IT assistance

- Contact customers who have not actioned the document before the payment due date

- Focus on high-value invoices

- Monitor customer behavior to help identify trends and proactively follow up with those who are slow to act

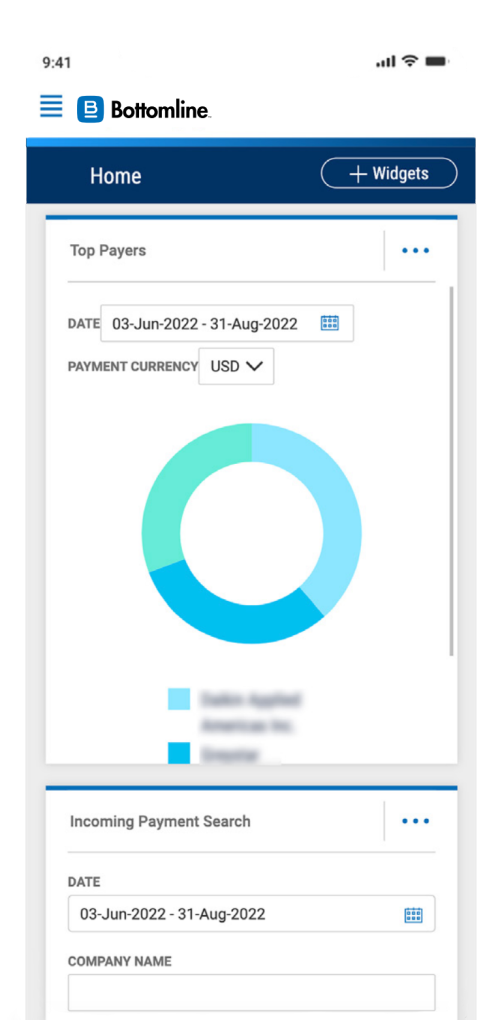

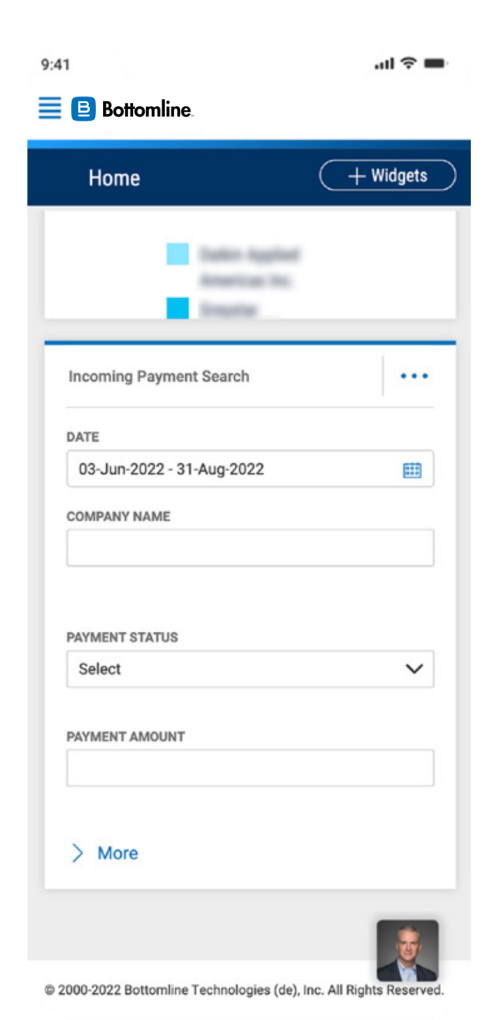

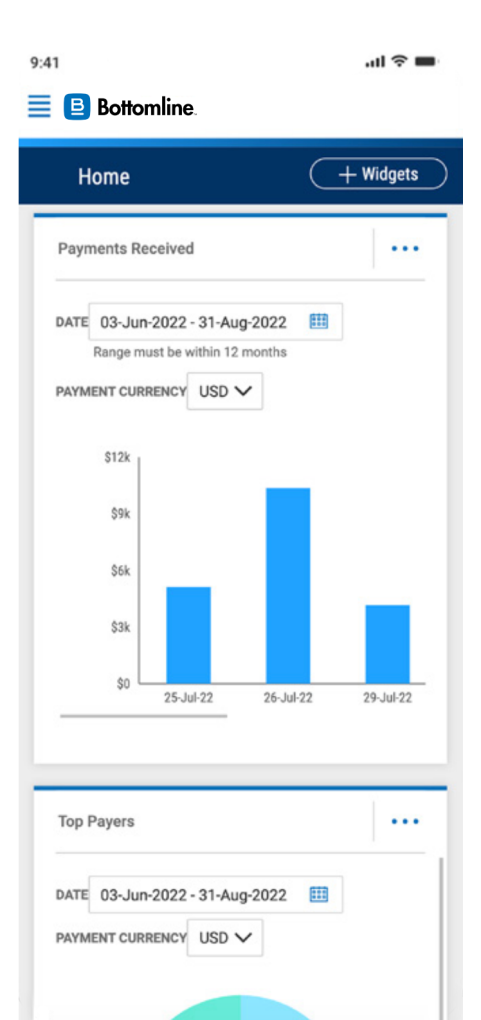

Paymode mobile app

Download the Paymode mobile app to track incoming payments, see new messages, and more using easy voice commands.