Direct Debit is a tried and tested method for paying regular bills – and it is not in danger of being replaced anytime soon. DD collection volumes in the UK rose by 2% to 4.7 billion in 2022, accounting for 10% of all transactions and worth a staggering £1.3 trillion, according to UK Finance. It is used by consumers to make around seven out of 10 of all regular bill payments.

Notably, UK Finance expects Direct Debits to grow at a fairly steady rate over the next decade, with 5.0 billion transactions forecast in 2032.

However, while it has been a reliable Bacs scheme for more than 50 years, Direct Debit is also evolving. As such, it is important for companies to stay abreast of the changes to make their collections more efficient and secure, as well as reduce fraud.

For example, Confirmation of Payee (CoP), an account name-checking service initially launched in 2020 to counter authorised push payment (APP) fraud, can now be used to verify account details that are provided when creating Direct Debits helping businesses ensure a seamless and secure experience for both payment and collection activity.

Companies need to be aware of ongoing changes to the guarantees and rules governing Direct Debits to ensure their business is compliant. For example, as of 24 May 2024, Direct Debit indemnity claims now require service users to log into the Payment Services Website to challenge incorrect claims.

There are many more changes coming down the line, including the next version of the Direct Debit Scheme guide and rules, and the New Payments Architecture (NPA)/National Payments Vision (NPV). There is also an industry consultation on the future of Direct Debits.

Challenges staying up to date

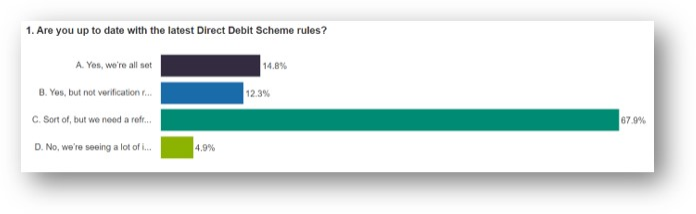

Many companies face difficulties staying on top of the numerous developments. During a recent Bottomline webinar on The Fundamentals of the Direct Debit Scheme Rules, a poll of over 500 attendees found that less than 15% felt they were up to date with the latest Direct Debit Scheme rules. Almost seven out of 10 indicated that they needed more information.

Avoiding costly exceptions

The verification process is essential for regulatory compliance and to get the mandate submitted, accepted and the all-important first collection on the way. Errors that cause exceptions, such as where a customer has entered an invalid account number, the account closed or account transferred, are identified during an account verification process. But it can also help throughout the lifetime of the Direct Debit.

Currently, Bottomline sees a 2% failure rate in collections on average.

Exceptions are costly. For a mid-sized corporate that has 300,000 Direct Debits per annum of £50 million, 2% represents about £1 million of delayed or potentially lost payments. There is also a significant operational cost associated with such failures. Depending on the automation level, this could be up to £50 per manual intervention.

Another audience poll on the webinar found that for Direct Debit exception handling almost one in six still uses manual processes, with 37% acknowledging that their manual process needs improvement. A mere 13% uses third-party automation tools.

However, a manual process is fragmented and non-integrated. For example, spreadsheets bolted together may work for smaller businesses but as the complexity of the business increases, the need for integration increases, especially when it comes to reducing the estimated £50 overhead costs associated with exception handling.

Plus, there have been many developments in third-party tools, such as automatically generated payment links. Essentially, a link – embedded in a letter, email, QR code or SMS – goes through to a payment page for capturing the payment by another method, whether via cards or Open Banking, such as Pay by Bank. From the recipient’s point of view, it is a low friction payment process: read, click, pay. These developments can offer operational cost savings for customers who cancel their Direct Debit or when failures happen.

Open Banking

In another development, Open Banking for single domestic payments, or one-off collections, is growing. Fifty million successful single payments are made per month in the UK, which shows greater consumer recognition and adoption. Currently, variable recurring payments (VRP) exist for the original use case of a ‘me-to-me payment’, which is not fit for purpose for the typical Direct Debit billing scenario.

Commercial VRP (cVRP) is in the making but payment protection needs to be in place so that the participants’ roles and liabilities are understood. Currently, an industry pilot is proceeding in low-risk sectors where the risk of chargeback and refunds are low.

One of the debates around the payer protection is whether it will look like the current credit card chargeback, or resemble Direct Debit indemnity. However, it is widely believed that until that is settled, cVRP will not see great uptake by businesses.

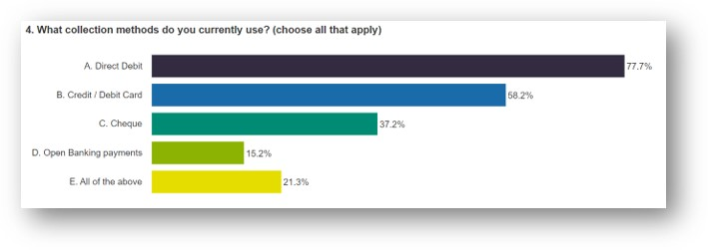

In terms of which commercial collection methods the audience members use most, more than three-quarters use Direct Debit. Surprisingly, cheques are still used by more than a third, while Open Banking is used by more than 15%.

Ultimately, the aim should be to offer payers a choice of payment method that best suits the purchase and what they are most comfortable

Coping with upcoming changes

We are all waiting to see what happens with the NPA, which was paused in November following the Future of Payments Review and the subsequent announcement that a National Payments Vision would publish in the middle of 2024.

Within the next few months, we should hear more about what will happen with the NPA. If you are a Bottomline customer on PTX, our strategy is to insulate you from the change. We intend to interface into NPA, which means our customers won’t have to change their back-end systems.

What we do know is that Direct Debit won’t be going anywhere anytime soon – even when the NPA progresses. It is likely we will see new payment types evolve and work as a back-up for Direct Debit failures or for taking the first payment on account, but Direct Debit will probably remain the most popular way of paying bills for some time yet. For companies whose Direct Debit process needs some love, Bottomline’s team is here to help improve what is in place today.