What are the current cash management challenges companies are facing related to people and technology in our ever-evolving digital world? How are companies addressing cash management challenges by investing in their treasury teams and technology to take more control of cash? How will the realm of cash management change in 2025?

The inaugural Cash Management in a Digital World survey was designed to assess these very questions. The survey garnered responses from treasury professionals from over 260 companies in commercial real estate, manufacturing, healthcare, higher education, transportation & logistics and warehousing.

This is the first blog in a five-part blog series that will delve into the survey results and implications. This blog will focus on the results at a high level and serve as a preview for the upcoming webinar “Cash Management in a Digital World: Benchmarks, Technology, Challenges, Opportunities”. The next four blogs will dive deeper into findings among the commercial real estate, manufacturing, healthcare, and higher education industries.

Effective cash management for treasury teams means optimizing the predictability of payments and receipts, which can be achieved by controlling the types and timings of payments and the types and timing of cash inflows and outflows.

The most common cash management challenges faced by survey respondents are:

-

Difficulties in collaboration with accounts payable (AP) and accounts receivable (AR).

-

Time misallocated on non-value-add activities.

-

Lack of cash forecasting speed and accuracy.

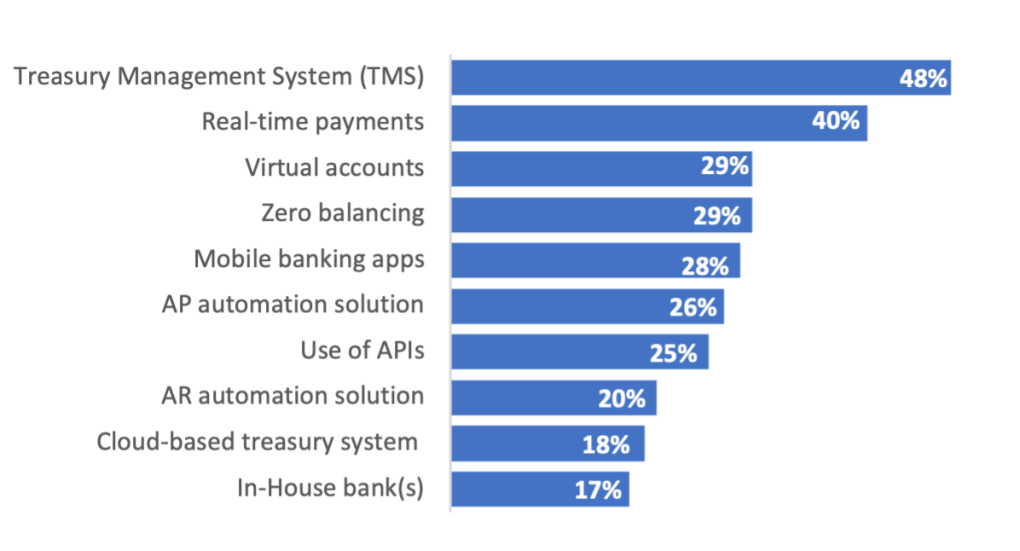

Figure 1. Technology Being Leveraged in Managing Cash

Silos are prevalent within treasury teams, between AP and treasury and between AR and treasury. Silos represent inherent barriers to cash management success. Common root causes of silos among survey respondents are the use of different systems, a lack of access to the same data, and the lack of incentive to collaborate within and beyond treasury. Companies would do well to identify any cash management silos that exist, why they exist and invest in mitigating these silos. The right technology can mitigate time spent on non-value activities and improve cash forecasting speed and accuracy. The companies surveyed are investing in AI, data lakes, virtual accounts, and real-time payments to mitigate these challenges to improve cash management (Figure 1.)

Figure 2. Top Skills for Treasury Teams to Upgrade in 2025

Companies also need the right people with the right skill sets to effectively manage cash. The companies surveyed are, and will be, investing in upgrading the skill sets of their treasury team and/or adding treasury team headcount to facilitate cash management success. These companies are focusing on upgrading cash management skills, data management, and technology acumen among treasury teams. Forty-six percent of companies surveyed indicated they expect to add to their treasury staff in 2025.

Five key takeaways from the survey analysis are:

-

Top cash management challenges are time misallocated on non-value add activities, a lack of cash forecasting speed and accuracy, and lack of collaborating with AP and AR.

-

Treasury teams need to assess and take more control/exert more influence over treasury technology, AP, and AR.

-

Treasury teams need to identify and mitigate cash management silos between AP and treasury and AR and treasury to more effectively manage cash.

-

Treasury teams are investing in technology including AI, data lakes, virtual accounts and real-time payments to improve cash management relative to efficiency and risk management.

-

Companies are investing in their treasury teams with a focus on upgrading cash management, data management, and technology acumen, data analysis and business partnering.

If you want to discover more of the results including analysis relative to industry and company size, and implications of the survey results, you can register for the Cash Management in a Digital World: Benchmarks, Technology, Challenges, Opportunities webinar taking place on September 18 HERE.

Stay tuned for the next four blogs in this five-part blog series.